Obama Legacy Already Crumbling As Federal Judge Blocks Overtime Rule

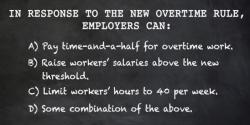

Ever a big fan of unilateral "rule changes," back in May of this year Obama and the Department of Labor implemented a new overtime regulation that was set to take effect on December 1st. The rule change called for increasing the minimum salary threshold at which employers would have been required to pay overtime to workers from $23,660 to $47,476, or a mere 101%. The rule would have required employers to pay time-and-a-half to salaried workers making less than $47,476 per year for any time worked in excess of 40 hours per week. According to the Wall Street Journal, the new regula