Goldman Crushes Democrat's Dreams: Shows Obamacare Has Cost "A Few Hundred Thousand Jobs"

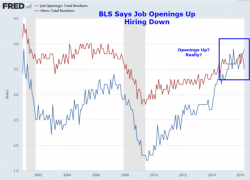

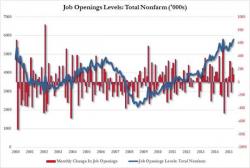

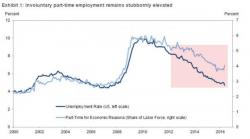

We suspect Lloyd Blankfein will be receiving a call from The White House (or Treasury) very soon as Goldman Sachs' economists did the unthinkable in the age of political correctness - while investigating the state of under-employment in America, the smartest people in the room found that ObamaCare has led to a rise in involuntary part-time employment, estimating that "a few hundred thousand workers" have been forced to cut hours and has "created disincentives for full-time employment."