"Billions Lost"

Submitted by Lance Roberts via RealInvestmentAdvice.com,

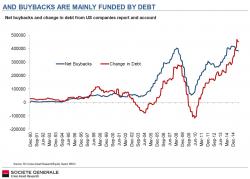

Companies Lose Billions On Stock Buybacks

I recently wrote an article about why “Benchmarking Your Portfolio Is A Losing Bet.” In that missive, I discussed all the things that benefit a mathematically calculated index versus what happens in an actual portfolio of securities. One of those issues was the impact of share buybacks: