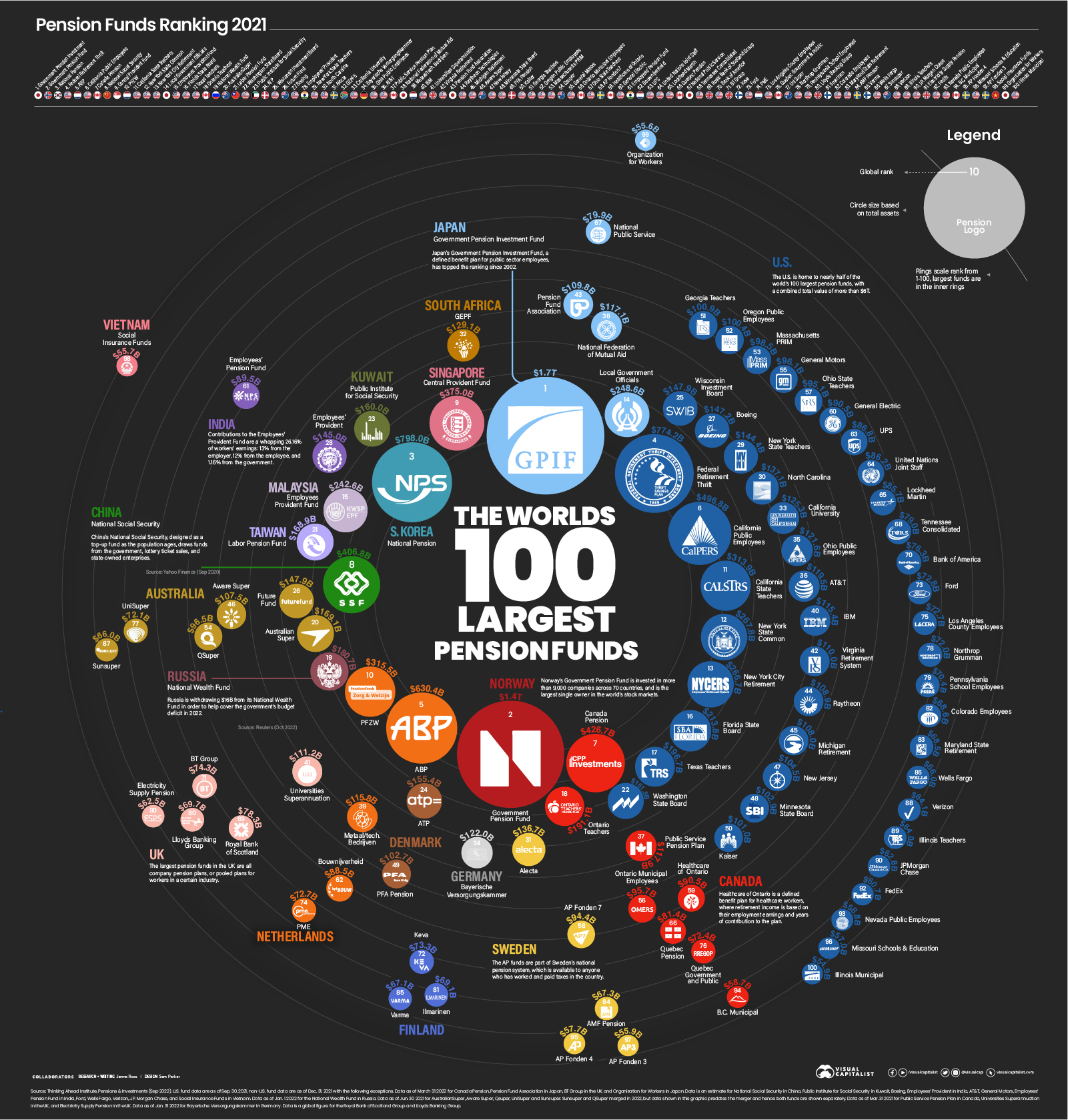

Ranked: The World’s 100 Biggest Pension Funds

View the full-resolution version of this infographic

Ranked: The World’s 100 Biggest Pension Funds

View the high-resolution of the infographic by clicking here.

Despite economic uncertainty, pension funds saw relatively strong growth in 2021. The world’s 100 biggest pension funds are worth over $17 trillion in total, an increase of 8.5% over the previous year.