When Health Insurance Works: A Look Inside Switzerland's Healthcare System

Authored by Marcia Christoff-Kurapovna via The Mises Institute,

[Part of a series on the Swiss economy and society.]

Authored by Marcia Christoff-Kurapovna via The Mises Institute,

[Part of a series on the Swiss economy and society.]

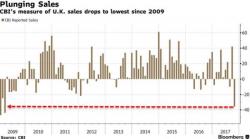

Yesterday we noted the surge in cable following the stronger-than-expected Q3 GDP print of 0.4% Q/Q, above the 0.3% estimate. Afterwards, the market was calculating an 87% chance that the BoE would hike next week. Brown Brothers commented that:

The case against a hike is that inflation appears poised to peak shortly, the economy is softening, and real wages are falling. This may already be squeezing households, where an increase in the base rate is quickly passed through to households.

Last week we noted that, after months of planning and cogitating over how to address the failing public pension systems in their state which are somewhere between $40 and $80 billion under water, Kentucky's Governor Matt Bevin and the leaders of the General Assembly’s Republican majorities released their highly-anticipated 'plan' which turned out to be nothing more than the same old "kick the can down the road" approach to "pension reform" that has perpetuated the pension ponzi in this country for decades while doing absolutely nothing to address the actual crisis.

Poor Elon Musk really, really can't catch a break. Just over the past couple of weeks he's been forced to push back his Model 3 delivery schedule due to some "production hell" issues (like not knowing how to weld...a fairly critical component of auto manufacturing), got one-upped by Daimler who beat him to the punch by revealing an all electric semi-truck earlier today (several weeks ahead of Elon), was sued by former employees who alleged a "hostile and racist work environment" in his Fremont plant...and the list goes on and on.

A ‘fixer upper’ is a charitable term for what this is.

In a story that exposes just how obscenely overvalued San Francisco’s housing market has become, Business Insider reports that one motivated real estate agent in San Francisco is seeking a buyer for a home in the tony Bernal Heights neighborhood that was completely gutted in a fire last year, and needs to be demolished and completely rebuilt – a project that would likely run into the millions of dollars.