Dallas Fed's Kaplan Says America Needs More Immigrants to Fill 'Skills Gap'

Content originally published at iBankCoin.com

According to Dallas Fed's Kaplan, America has an over abundance of jobs and needs to attract wanton amount of migrants in order to fill the insatiable demand for cheap labor, aka 'skills gap.'

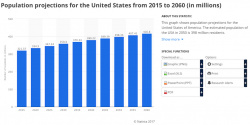

While on one hand, Kaplan ceded to the notion that globalization was a primary reason for price deflation and stagnant growth, he also blamed America's aging demographics for lackluster growth.