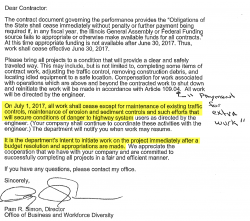

Unable To Pay Bills, Illinois Sends "Dear Contractor" Letter Telling Firms To Halt Road Work On July 1

Authored by Mike Shedlock via MishTalk.com,

The state of Illinois has not passed a budget for close to three years.

Arguably it’s just as well because Illinois budgets for decades have been nothing but a moth-eaten collection of lies, one time deficits repeated endlessly, and financial wizardry statements designed to disguise Illinois’ real problems: failure to rein in spending coupled with a very business unfriendly environment.