Watch Live: Paul Ryan Holds Press Conference On What Happens Next

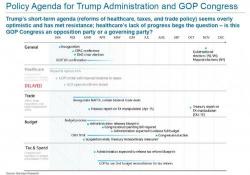

Paul Ryan and GOP leaders are holding a press conference to discuss next steps in the aftermath of Friday's failure to repeal Obamacare, and as CBS reports, among other discussion topics, the GOP is currently contemplating ways to revive the repeal of Obamacare, with CNN adding that Ryan may potentially re-engage the Freedom Caucus.