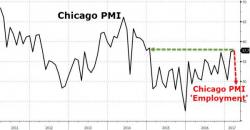

Chicago PMI Jumps To 2 Year Highs Despite Plunge In Employment Index

The good news - another 'soft' survey data item inches to a new post-Trump high as Chicago PMI rises to 57.7 - highest since Jan 2015. However, the bad news is that exuberant hope is not translating into hard reality as the employment sub-index collapsed into contraction.

The 57.7 print beat expectations of a modest decline to 56.9, but the employment component crashed from 57.7 to 49.9 - into contraction.

Business barometer rose at a faster pace, signaling expansion