Europe Falls, U.S. Futures Rise As Oil Halts Two-Day Plunge

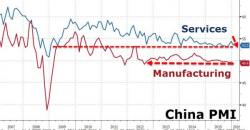

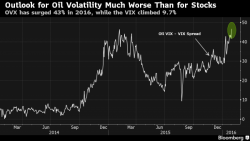

While the biggest news of the night had nothing to do with either oil or China, all that mattered to US equity futures trading also was oil and China, and since WTI managed to rebound modestly from their biggest 2-day drop in years, continuing the trend of unprecedented, HFT-driven volatility which has far surpassed that of equities and is shown in the chart below...