Goldman: "Our Client Conversations Make It Clear That Investors Fall Into Two Camps"

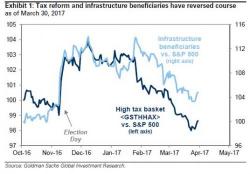

Judging by recent market action, it is becoming apparent that traders and investors are getting if not tired, then displeased with having to trade what boils down to one of two narratives: Trump Reflation Trade On, and - as has been the case recently - Trump Trade Off. As much is apparent in the latest weekly kickstart note from David Kostin who writes that with the market struggling to readjust its expectations for US government policy following the move away from health care reform, client conversations make clear that investors fall into two camps: