"It's A Series Of Rolling Mini-Bubbles"

Authored by Kevin Muir via The Macro Tourist blog,

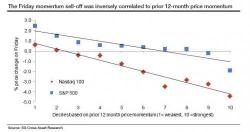

Think back to earlier this year. At the time, the market was convinced Trump was about to usher in a new wave of free market nirvana. Hedge fund managers piled into small cap equity long positions, confident the pro-growth policies would fuel a massive outperformance for the Russell 2000 index. Here is a chart I ran in my piece “The reality is something in between” which shows the extent of the small cap run: