In The Shadows Of Black Monday - "Volatility Isn't Broken... The Market Is"

Authored by Christopher Cole via Artemis Capital Management,

A full version of the article is available on the Artemis website.

Volatility and the Alchemy of Risk

Authored by Christopher Cole via Artemis Capital Management,

A full version of the article is available on the Artemis website.

Volatility and the Alchemy of Risk

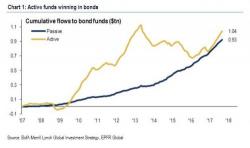

According to the latest EPFR fund flow data compiled by BofA's Michael Hartnett, the great "institutional to equity" stockholding rotation is accelerating, with another $8.8bn allocated to equities, more than all of it from retail investors, and another $5.8bn going into bonds, offset by a $0.4bn outflows from gold.

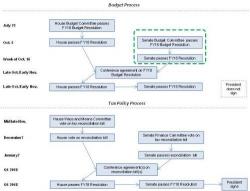

Global stocks hit new all time highs overnight, with US stock-index futures, Asian and European stocks all rising overnight after the Senate adopted a fiscal 2018 budget resolution, paving the way for Trump's $1.5 trillion in tax cuts, while news that "dove" Jay Powell may be the next Fed chair added to the risk-on sentiment.

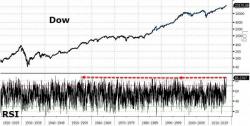

30 year ago today, traders were having a bad day: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -11%, -9% and -10% respectively. The FTSE fell a further 12% the day after, reflecting the difficulties in fully reopeningthe market after the great storm a few days before. The day would eventually become known as Black Monday.

Has the market's "melt-up" levitation finally ended? Of course, it could be much worse: as Bloomberg's Paul Jarvis recalls, thirty years ago on this day traders around the globe were staring at their screens in disbelief as stock markets turned to a sea of red: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -10%, -9% and -10% respectively.