Euro Surges, Yields And Stocks Rise As Central Banks Deliver Coordinated Message

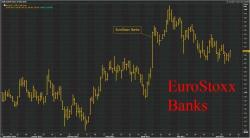

The euro soared to the highest level in over a year while bond yields and global shares also climbed, as an ongoing barrage of coordinated hawkish comments from central banks signaled the era of easy money might be coming to an end for more than just the United States. S&P futures were fractionally in the green following the best day for US equities in two months, as banks climbed after passing the Fed's stress tests and announcing bigger than expected shareholder payouts.