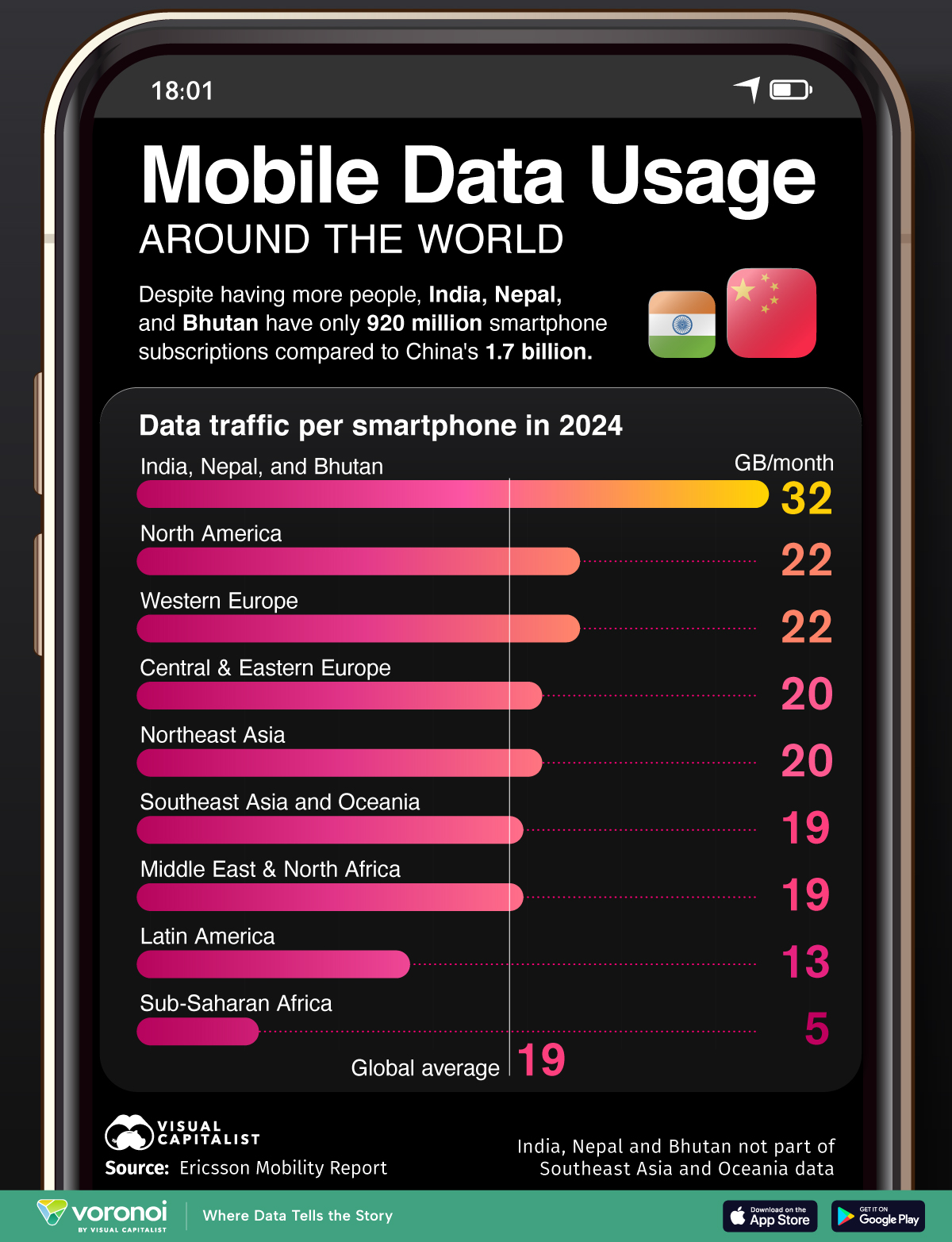

Charted: Mobile Data Usage Around the World, by Region

![]()

See this visualization first on the Voronoi app.

Use This Visualization

Mobile Data Usage Per Phone, by Region

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.