"Maced Girl" Who Punched Trump Supporter May Be Charged By Police

One of the truly remarkable things about Donald Trump's run for the White House is the extent to which he has proven to be immune to criticism.

One of the truly remarkable things about Donald Trump's run for the White House is the extent to which he has proven to be immune to criticism.

The Great Divide: The Death of the Middle Class

Written by Jeff Nielson (CLICK FOR ORIGINAL)

Several months ago, a chart produced by one of the Big Banks was presented to readers . It was supposed to be innocuous data on global wealth distribution, but instead portrayed a horrifying picture.

Submitted by Nick Cunningham via OilPrice.com,

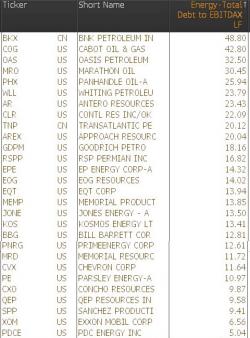

Lenders to the oil and gas industry have been extraordinarily lenient amid the worst downturn in decades, allowing indebted companies to survive a little while longer in hopes of a rebound in oil prices. But the screws are set to tighten just a bit more as the periodic credit redetermination period finishes up.

Submitted by 'Jeremiah Johnson', retired Green Beret, via SHTFPlan.com,

Many of the things that are happening this very moment have direct parallels in literature of the past. Whether it is an account such as the “Gulag Archipelago” by Solzhenitsyn or a work of “fiction” such as “1984” by George Orwell is irrelevant. Elements of the history or the storyline (regarding the former and the latter works) are now becoming thoroughly inculcated into the fabric of modern reality.

With all of Europe and the Americas closed for holiday, what little market action there was overnight came out of Asia, where China once again was engaged in its last hour "National Team" market manipulation, which saved the SHCOMP from a red close after the now traditional last hour buying spree, pushed the Shanghai Composite from red on the session an hour before close to near the highs of the day.