Gasoline Glut Could Ruin The Oil Price Party

Submitted by Nick Cunningham via OilPrice.com,

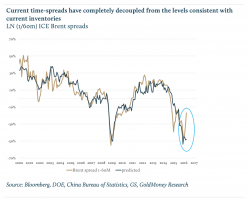

Oil and refined products inventories in the U.S. continue to climb at a worrying pace, raising some red flags for an oil market that was supposed to be on the mend.

Crude oil inventories jumped by a whopping 6.5 million barrels last week, rising to 494.8 million barrels. Oil stocks have now increased every week of 2017, and are now not far off from the 80-year highs reached in 2016.

(Click to enlarge)