What Will Drive The Next Oil Price Crash?

Authored by Tsvetana Paraskova via OilPrice.com,

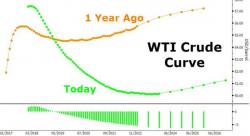

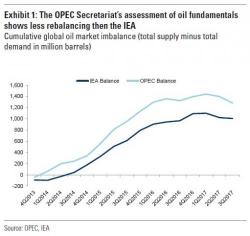

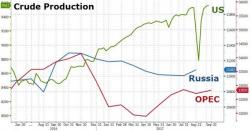

As we roll into 2018, analysts and investors are more optimistic that the oil market will further tighten next year and support higher oil prices, but rising U.S. shale production will likely cap any significant price gains.

On the demand side, expectations are that global economic growth will support solid oil demand growth.