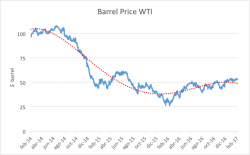

Why We Should Be Concerned About Low Oil Prices

Authored by Gail Tverberg via Our Finite World blog,

Authored by Gail Tverberg via Our Finite World blog,

Authored by Daniel via The Mises Institute,

Many analysts are venturing to link the crisis that plagues the Venezuelan economy with the fall in the price of crude oil. With oil being one of the most important commodity in Venezuelan production and the country’s main export product, it seems that the fall in the price would bring any country with an economic structure similar to Venezuela’s into a crisis. Similarly, many assume that the problems in Ecuador have the same root as those in Venezuela, although less pronounced.

Authored by Nick Cunningham via OilPrice.com,

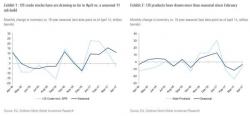

Global oil inventories have started to decline and the supply/demand balance will soon tip into a deficit, if it hasn’t already. That will accelerate the drawdowns in crude oil stocks, and bring the market back into “balance,” providing a lift to oil prices.

That, at least, is the working assumption. But there are a series of gigantic question marks out there – a handful of countries could upend the theory that the oil market is on a smooth trajectory towards balance.

"Ignore the drop in oil prices... it's just technical" is the message from Goldman's bullish Damien Courvalin who believes fundamentally the pace of the inventory declines are encouraging and does not see evidence in the oil market to justify this (negative) shift in sentiment. In other words, BTF Oil Dip!

Another technical oil sell-off

Authored by Osama Rizvi via OilPrice.com,

Amidst the din of analysts speculating about whether oil prices will rise or fall, observers may well be overlooking some pressing questions about the very nature of the global oil market. The most significant of these questions relates to whether Saudi Arabia is losing its grip on the global oil market and if U.S. oil and gas producers are replacing the Saudis as the key global swing producer.