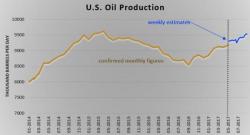

How EIA Guestimates Keep Oil Prices Subdued

Authored by Nick Cuningham via OilPrice.com,

The EIA has once again undercut its previous estimates for U.S. oil production, offering further evidence that the U.S. shale industry is not producing as much as everyone thinks.