First Footage Emerges Of Armed Clashes Between Kurdish And Pro-Baghdad Forces Near Kirkuk

Does this mean war yet?

Does this mean war yet?

Authored by Nicholas Trickett via OilPrice.com,

Oil Royalties

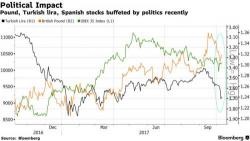

S&P futures are again modestly in the green as European shares hold steady ahead of a meeting of the Catalan regional parliament and a possible declaration of independence by Catalan leader Puigdemont, while Asian shares rise a the second day. The dollar declined for the 3rd day, its losses accelerating across the board amid growing concerns that Trump's tax reform is once again dead following the Corker spat and a rejection from Paul Ryan, with the move gaining traction after China set the yuan’s fixing stronger for the first time in seven days.

Authored by Federico Pieraccini via The Strategic Culture Foundation,

As seen in my previous article, US military power is on the decline, and the effects are palpable. In a world full of conflicts brought on by Washington, the economic and financial shifts that are occurring are for many countries a long-awaited and welcome development.

If we were to identify what uniquely fuels American imperialism and its aspirations for global hegemony, the role of the US dollar would figure prominently.

China Catalyst To Send Gold Over $10,000 Per Ounce?

Jim Rickards is on record forecasting $10,000 gold.

But is China about to provide the catalyst to send gold even higher? And by how much?

Today, we fare forth in the spirit of speculation… follow facts down strange roads… and arrive at a destination stranger still…

China — the world’s largest oil importer — struck lightning through international markets recently.

According to the Nikkei Asian Review, China has plans to buy imported oil with yuan instead of dollars.