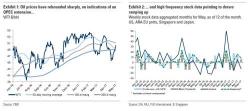

Goldman Warns Of "Sharp Oil Price Drop", Inventory Glut "If Backwardation Is Not Achieved"

Increasingly some of the more prominent sellside analysts appear to be picking and choosing ideas from their competitors. Earlier, it was JPM echoing Goldman's reco when it cut its 10Y yield forecast. Now, in a note previewing the outcome of this week's OPEC meeting and proposing a way forward for OPEC, Goldman's Damien Couravlin adopted the "backwardation" idea presented last week by Morgan Stanley's Francisco Blanch.