Trader: "The Bigger Picture On Oil Is Far More Negative"

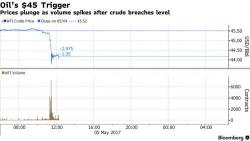

With oil prices spiking nearly 10% from last Friday's sudden, capitulation "flash crash" which was perhaps driven by Pierre Andurand liquidating his entire long book, there has been a scramble by analysts to "fit" the narrative to the price action and the sudden change in momentum, most notably by Goldman, which continues to pump one after another bullish crude note, we suppose because Goldman's prop trading desk still has some oil left to sell to clients.