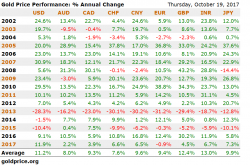

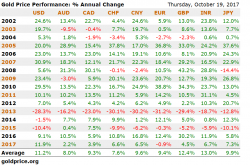

Gold Up 74% Since Last Market Peak 10 Years Ago

Gold Up 74% Since Last Market Peak 10 Years Ago

Gold Up 74% Since Last Market Peak 10 Years Ago

For the first time since Gold suffered a "death cross" in 2014, the largest 3-week inflows into gold funds since June 2009 have set up a so-called bullish "golden cross" pattern in the precious metal.

On the week, BofA's Michael Hartnett reports big precious metals inflows of $2.6bn as investors flee from stocks (equity outflows of $2.7bn).

Submitted by Axel Merk via Merk Investments,

Gold never changes; it's the world around it that does. Why is it that we see a renewed interest in gold now? And more importantly, should investors buy this precious metal?

Key attributes in a 'changing world' that may be relevant to the price of gold are fear and interest rates. Let's examine these:

Gold & Fear