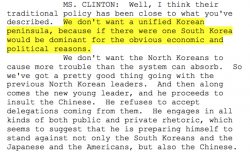

What Hillary’s Goldman Sachs Speeches Revealed About Changing Tides In The Koreas

Via Disobedient Media

Via Disobedient Media

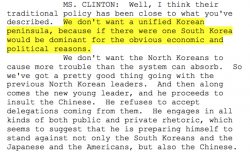

With the rise of communist candidate Melenchon throwing the French election results into disarray for the status quo supporters, it appears traders are rushing headlong for the safety of core-core Europe and rapidly exiting anything to do with France.

As reported in our overnight wrap, the recent surge in far-left candidate Melenchon has changed the French presidential election calculus materially in recent days, sending the spread between French and German 10Y blowing out again, helped by yesterday's Goldman downgrade of French OATs.

With volume starting to fade ahead of Friday's holiday, and geopolitical concerns growing as a US aircraft carrier approaches North Korean, S&P futures pointed to a slightly lower open, in line with stock markets in Europe and Asia. Safe havens such as gold and treasuries strengthened along with Japanese yen, which erased all of yesterday's losses and neared its 110 support on investor caution about global security risks and the future of U.S. interest rates after Yellen's Monday speech failed to provide clarity.

Submitted by Stock Board Asset Management

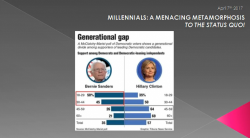

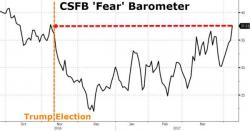

While US stocks were relatively stable last week (amid death-feying BTFD rips), investors are paying the most for equity protection since before the U.S. presidential election in November.

As Bloomberg reporets, Credit Suisse's Fear Barometer, which measures the cost of bearish to bullish three-month options on the S&P 500 Index, has climbed for six straight days, its longest streak since August.