One Trader Asks: "Is Time To Stop Worrying About The Euro?"

Mark Cudmore, prolific Bloomberg markets commentator and former FX trader, asks a question that may validate all the work the ECB has put together in its "whatever it takes" effort of the past five years: is it time to stop worrying about the euro falling apart. For what it's worth, we believe the answer is a resounding no, for all the reasons anothr Bloomberg analyst, Richard Breslow, explained yesterday.

From Marc Cudmore's daily Macro View

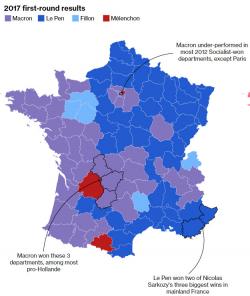

A Macron Victory Should Seal Euro Narrative Shift: Macro View