Global Stocks Slide As Iron Ore Crashes; Pound Jumps After UK Calls Snap Elections

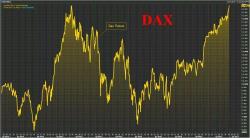

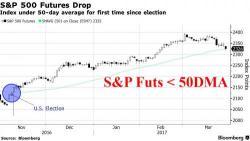

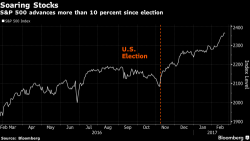

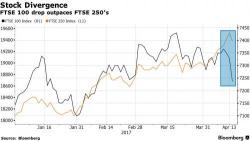

European stocks slide as traders returned from a 4-day Easter holidays, Asian equities likewise drop pressured by the ongoing rout in iron ore, while U.S. stock-index futures point to a lower open. British markets were roiled after U.K. Prime Minister Theresa May said she would seek an early election on June 8, in a move aimed at strengthening her hand going into Brexit talks; the FTSE 100 dropped 1.3%, on the news, hitting the lowest since Feb. 24 while 10Y Gilts dropped below 1% for the first time since October.