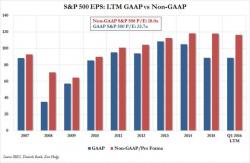

Why Management Is Incentivized To Fabricate Earnings: It's All About non-GAAP Bonuses

When it comes to the stock market, there is no single greater observable divergence right now than that between GAAP and non-GAAP earnings. As the chart below shows, while on a non-GAAP basis earnings have been hurting in recent years, with the LTM EPS of the S&P has declined to 116.4, down from 118.1 as of December 31, 2014, the real surprise is in GAAP EPS, which are back down to 88, a level last seen in 2007 when the market was about 500 points lower.