"Killer Wave" Confirms Big Bear Market Looms

Excerpted from James Stack's InvesTech.com,

Technical Evidence: Confirming a bear market

Excerpted from James Stack's InvesTech.com,

Technical Evidence: Confirming a bear market

While the S&P 500 held support at January low (1,812) yesterday (and October 2014's Bullard bounce lows), BMO's Russ Visch warns "it may not hold in the days ahead" due to weak market breadth.

Given the ongoing collapse in market breadth (now breaking well below January's lows), BMO's Visch adds...

The S&P 500 is down 8.02% YTD through the first five sessions of February. This is the second worst start to the year going back to 1928 and the weakest since 2008, when the S&P 500 dropped 8.95% YTD through the first five days of February. This, as BofAML's Stephen Suttmeier details, compares to an average 1.16% gain for this period. The S&P 500 also has bearish signals for the Nov-Jan and January barometers. This is a risk for 2016.

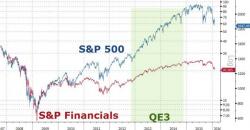

Large cap financials have had an awful time in the last month and are 11.7% lower so far in 2016.

As ConvergEx's Nick Colas details, that’s worse than pretty much anything else, including all other S&P 500 sectors, the Russell 2000 small cap index, and even the MSCI Emerging Markets Index.

Excerpted from Doug Noland's Credit Bubble Bulletin,