The Simplest Reason Behind Collapsing Volatility: Hedge Funds Are Barely Trading

"Gamma", "vega", CTAs, risk-parity, vol-neutral, central bank vol-suppression, the soaring popularity of (inverse) VIX ETFs , and so on: over the past year there have been countless attempts to explain why despite the surging political uncertainty in recent years, and especially since the US election...

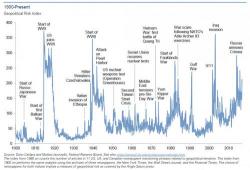

... global equity volatility, both implied and realized, has tumbled to record lows, sliding even below levels not even seen before the 2008 financial crisis.

There may be a much simpler reason.