In The Shadows Of Black Monday - "Volatility Isn't Broken... The Market Is"

Authored by Christopher Cole via Artemis Capital Management,

A full version of the article is available on the Artemis website.

Volatility and the Alchemy of Risk

Authored by Christopher Cole via Artemis Capital Management,

A full version of the article is available on the Artemis website.

Volatility and the Alchemy of Risk

The general sentiment on the Convergex trading desks continues to be bearish, so today Nichaolas Colas reviews seasonal patterns for the CBOE VIX Index going back to its starting point in 1990 to see what that math says about current market risk.

The following research was jointly produced by: J. Brett Freeze, CFA of Global Technical Analysis and 720 Global

Buying Dollar Bills For $1.10

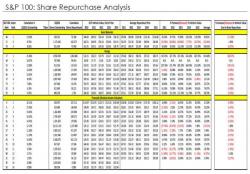

720 Global has written four articles to date on stock buybacks and the harm these actions will likely have on future corporate growth rates and the economy. To better gauge the effect of buybacks we join forces with Brett Freeze to present a unique analysis on the S&P 100.

The biggest macro development over the weekend was China's latest "gloomy" economic update, in which industrial production, retail sales and lending figures all missed estimates, however now that we are back to central bank bailout mode, bad news is once again good news, and the Shanghai Comp soared +1.7% among the best performers in Asia on calls for further central bank stimulus while the new CSRC chief also vowed to intervene in stock markets if necessary. In other words, the worse the data in China, the better.