Moving Closer To The Precipice

Authored by Pater Tenebrarum via Acting-Man.com,

Money Supply and Credit Growth Continue to Falter

Authored by Pater Tenebrarum via Acting-Man.com,

Money Supply and Credit Growth Continue to Falter

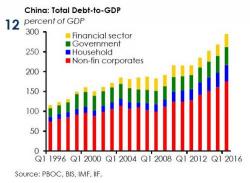

Not even last night's Moody's credit downgrade of China - the first since 1989 - could dent the global stock rally which has pushed global stock prices to all time highs. After initially sliding, regional stocks and emerging Asian currencies pared early losses following the unexpected downgrade of China, taking their cue from the "sudden reversal" of the Shanghai Composite Index, which some speculated saw the latest intervention of the "national team."

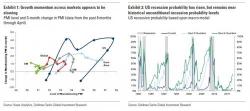

Under normal circumstances, we would say it is strange, if ironic, that the same day the S&P is trading just shy of an all time high 2,400 again, Goldman comes out with a note warning that "global growth momentum appears to be slowing. The ISM has likely peaked, and the US labor market has tightened further.

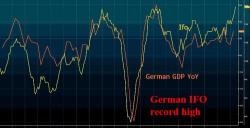

S&P futures rose alongside European stocks as Asian shares posted modest declines. The euro set a new six-month high and European bourses rose as PMI data from Germany and France signaled that the ECB will have to tighten soon as Europe's recovery remains on track, with the German Ifo business confidence printing at the highest level on record, and hinting at a GDP print in the 5% range. Oil declined after the Trump budget proposal suggested selling half the crude held in the US strategic petroleum reserve.

Authored by Daniel Lang via SHTFplan.com,

As time goes on, it’s becoming abundantly clear that Trump isn’t going to be able to prevent a major financial crisis in this country. Depending on your beliefs, that’s either because he’s inept in some way, or because he’s being hamstrung by a political system that’s determined to keep our nation on the same unsustainable path. Whatever the case may be, it seems that there is no way that we can change course at this point. We’re headed for a financial crisis, and it’s going to happen sooner rather than later.