Healthcare Reform Solves Nothing... It's The Debt, Stupid!

Authored by Lance Roberts via RealInvestmentAdvice.com,

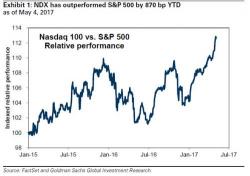

Over the last few weeks, I have been discussing the ongoing consolidation process for the S&P 500 from the March highs. (For a review read: “Oversold Bounce Or Return Of The Bull,” and “Return Of The Bull…For Now.”) As the expected rally in stocks, and reversal in bonds, took shape as the S&P 500 was finally able to ratchet a record close at 2399.29. (Read: 10/2016 – “2400 Or Bust”)