It's Never Been Cheaper To Hedge Highly Speculative Tech Companies

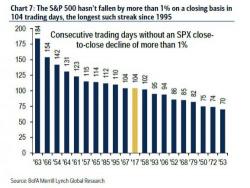

While many have noticed the demise of volatility in the US equity markets - 104 days without a 1% drop, plunge in VIX, record low monthly ranges - it is the most highly speculative and most over-valued companies that appear to be the biggest beneficiaries of peak animal spirits. It has never been cheaper to hedge stocks in the Nasdaq...

The great moderation of risk is nearing unprecedented lengths...

While expectations of short-term stock volatility is jumping...