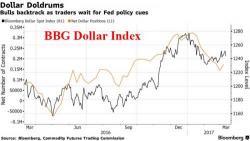

Global Stocks Drop Ahead Of Fed Rate Decision; Dollar Rises As Sterling Tumbles

European stocks declined for first session in five ahead of Wednesday's Dutch elections, debt ceiling expiration and the conclusion of the Fed's 2-day meeting where it is expected to raise rates by 25 bps. Tightening concerns emerged, also dragging down Asian shares and S&P futures, while the dollar continued its rise for a second day. Crude oil has ended its six-day drop. The pound tumbled 0.8% to the lowest since mid-January in a delayed reaction after Theresa May won permission to trigger the country’s departure from the EU.