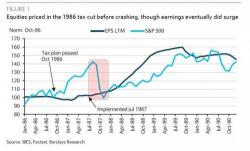

Barclays: "Equities Rushed To Price In The Reagan 1986 Tax Cuts Before Crashing In 1987"

With concerns rising that the market has gotten well ahead of itself over the practical reality of Trump tax cuts - most recently voiced by Goldman which over the weekend said that "we are approaching the point of maximum optimism and S&P 500 will give back recent gains as investors embrace the reality that tax reform is likely to provide a smaller, later tailwind to corporate earnings than originally expected" - Barclays decided to look at one of recent history's most notable tax regime changes: the Reagan tax cuts.

What it found was interesting.