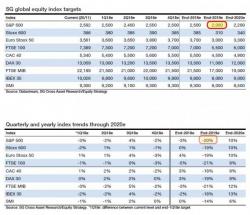

Just 10 Companies Account For 33% Of All Market Gains Since Trump's Election

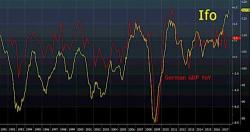

Yesterday we laid out the reasons why French bank SocGen unveiled a surprisingly contrarian forecast, according to which the S&P would tumble from its current level over 2,600 to 2,000 in 2018, representing a more than 20% bear market drop...

... the drop catalyzed by rising interest rates pressuring P/E multiples, a late cycle economy nearing recession, equities trading at record valuations, and with everyone short vol begging for a vol short squeeze. Not surprisingly, SocGen's unspoken advice was to get out now.