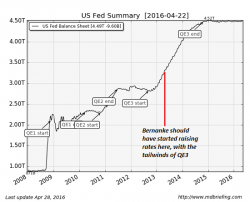

Bernanke Blew It Big-Time: He Should Have Raised Rates Three Years Ago

Submitted by Charles Hugh Smith from Of Two Minds

* * *

Bernanke blew it big-time, letting the "recovery" run seven years without any significant increase in rates.

Submitted by Charles Hugh Smith from Of Two Minds

* * *

Bernanke blew it big-time, letting the "recovery" run seven years without any significant increase in rates.

Forget BTFD... BTFATH is back.

A relentless stream of selling by Bank of America's "smart money" clients stretching for over 4 straight months, or 18 consecutive weeks, is finally over. As BofA's Jill Carey Hall reports, last week, during which the S&P 500 was flat from the prior week, BofAML clients were net buyers of US stocks for the first time in 19 weeks, breaking a record-long selling streak that began in mid-January.

“Someone” is getting desperate.

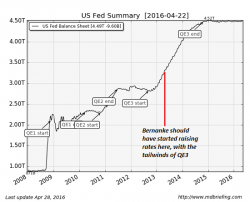

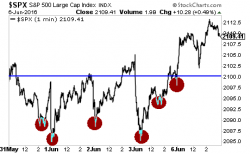

Throughout the last week, anytime stocks have begun to correct or drop, “someone” has bought S&P 500 futures to prop the market up.

Anyone who’s been involved with the markets for a while knows the difference between real buyers and manipulation. This is manipulation plain and simple.

Look at all those “V” rallies. Three days in a row stocks opened DOWN and someone immediately stepped in and began buying aggressively.

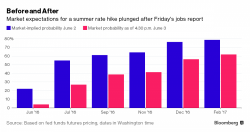

Stock whisperer Yellen said all the right things yesterday, when she sounded more optimistic than pessimistic on the economy but while the economy is "strong" it is most likely not strong enough to weather a rate hike in the immediate future.

Every ugly nonfarm payrolls has a silver lining, and sure enough following Friday's disastrous jobs report, global mining and energy companies rallied alongside commodities after the jobs data crushed speculation the Fed would raise interest rates this month. “The disappointing U.S. jobs report on Friday means that a summer Fed rate hike is off the table,” said Jens Pedersen, a commodities analyst at Danske Bank. “That has reversed the upwards trend in the dollar, supporting commodities on a broader basis.