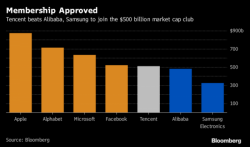

SocGen: Asian Equities Are So Awesome, A China Minsky Moment Is "Manageable"

If we’re going to discuss Asian equities in the context of “awesome”, we should begin with Tencent. Tencent, which has more than doubled this year, drove Asian stocks higher during Tuesday’s trading session. Trading on the main board of the Hong Kong Stock Exchange hit a 28-month high of HK$157 billion with one fifth of it in only two stocks – Tencent (HK$21.7 billion) and Ping An Insurance (HK$9.4 billion). It was hardly surprising that shares in Hong Kong Exchanges & Clearing also had a good day, rising 5.5%, the most in more than a year. Tencent’s 2.4% rise pushed it market cap.