Options Traders Continue Their Unusual Hedging

Via Dana Lyons' Tumblr,

While the stock market saw big gains yesterday, one options exchange reported a near-record level of relative put buying.

Via Dana Lyons' Tumblr,

While the stock market saw big gains yesterday, one options exchange reported a near-record level of relative put buying.

In his latest market commentary, presented by Reuters on Tuesday night, Gundlach remained skeptical on the stock market. Specifically, he said that the rally in U.S. stocks, which began on Monday, feels like a short squeeze and characterized U.S. stocks as "dead money."

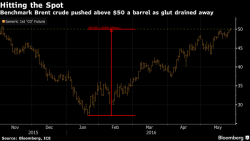

In what has been another quiet overnight session, which unlike the past two days has not seen steep, illiquid gaps higher in US equity futures (the E-mini was up 3 points and accelerating to the upside as of this writing so there is still ample time for the momentum algos to go berserk), the main event was the price of Brent rising above $50 for the first time since November with WTI rising as high as $49.97.

As shown in the chart below, Brent crude surpassed $50 a barrel for the first time since November, lifting commodity companies and buoying currencies where oil is produced.

Less than a decade ago, the mere hint that the Fed was either propping up markets or actively pushing them higher was enough to get one branded a conspiracy theorist loon and never again invited to polite conversation. Since then first Bernanke, and then virtually all central bankers both domestic and foreign have admitted that the "wealth effect", a polite way of saying pushing up asset prices, has been their primary goal and function.

Follow EM or not? That is the big question that BofAML asks as once again Emerging Market stocks are decoupling (lower) from an exuberant US equity market.