"The Global Negative Feedback Loop" - Why Investors Are Fleeing Capital Markets

The following comprehensive analysis of current market risks and concerns, represents one of the better summary assessments by both Brean Capital's Russ Certo as well as Bloomberg's market analysis team, of not only why there seems to be an increasingly more tangible sense of gloom covering global capital markets, but also why investors are increasingly withdrawing from risk, leaving central banks to duke it out among themselves.

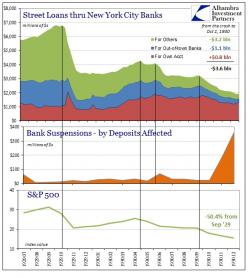

Traders Pull ‘Singed Fingertips’ From Markets as Risks Escalate