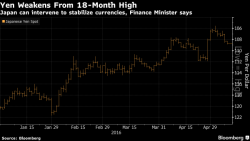

US Futures, European Stocks Drop As USDJPY Tumbles

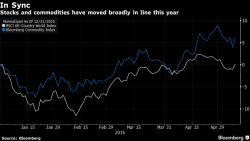

One day after the biggest jump in stocks in two months on what has still been an undetermined catalyst, overnight global equities did a U-turn with European stocks falling toward a one-month low and U.S. stock index futures declining, as crude oil dropped toward $44 a barrel. A driver the move lower was a sharp reversal in the USDJPY which dropped 100 pips from yesterday's highs which took places just as Goldman predicted the USDJPY has finally bottomed, facilitated by a weaker dollar (also following a Goldman report yesterday forecasting the USD was about to surge).