With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

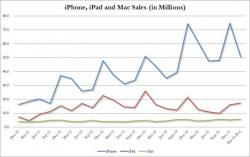

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing to explain. The FAANGs (Facebook, Apple, Amazon, Netflix and Google) own their niches and not so long ago were expected to generate strong growth pretty much forever. That’s why every large-cap mutual fund and most hedge funds (not to mention a few central banks) owned so much of them.