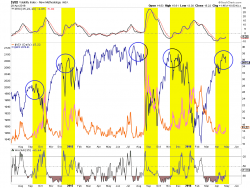

Weekend Reading: Yep... Still Looks Like A Trap

Submitted by Lance Roberts via RealInvestmentAdvice.com,

Last week, I noted technical breakout of the market above the downtrend line from last May, such a move required an increase in exposure to equity risk. To wit:

“With the breakout of the market yesterday, and given that ‘short-term buy signals’ are in place I began adding exposure back into portfolios. This is probably the most difficult ‘buy’ I can ever remember making.”