"Feeding The Monster" - The Complete Bear Case, In Charts

Via NorthmanTrader.com,

Via NorthmanTrader.com,

Via Dana Lyons' Tumblr,

The CBOE SKEW Index just closed at its lowest level since October 2014 – but is tail risk in the stock market really that low?

With oil losing some of its euphoric oomph overnight, following the API report of a surge in US oil inventories, and a subsequent report that Iran's oil minister would skip the Doha OPEC meeting altogether, the global stock rally needed another catalyst to maintain the levitation.

Submitted by Michael Lebowitz via 720Global.com,

On numerous occasions over the past year we suggested that U.S. equity valuations were expensive. Certainly the recent sharp rebound in share prices in the midst of declining earnings, lower earnings forecasts and slowing domestic and global economic growth has only strengthened our conviction.

In this article we compare equity valuations and the market drivers of 2013 to those today and outline why we think equities may be the so-called “bug in search of a windshield”.

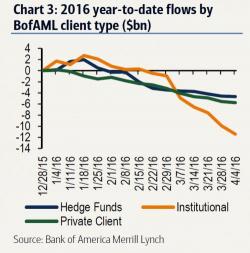

Last week when BofA reported that "everything is being sold" as its smart money clients (institutional, private and hedge funds) dumped stocks for a whopping 10th consecutive week, it said that "BofAML clients were net sellers of US stocks for the tenth consecutive week, in the amount of $3.98bn. Net sales last week were the largest since September, and the fifth-largest in our data history (since 2008). Since early March, all three client groups (institutional clients, private clients and hedge funds) have been sellers of US stocks."