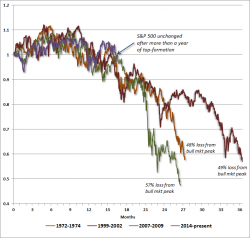

What Happens When The Market Goes Nowhere For One Year (Hint: Nothing Good)

Excerpted from John Hussman's Weekly Market Comment,

The single most important quality that investors can have, at present, is the ability to maintain a historically-informed perspective amid countless voices chanting “this time is different” and arguing that long-term investment returns have no relationship to the price that one pays.