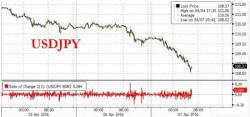

"There Is A Lot Of Fear In The Market" - Stocks, Futures Slide After Yen Soars

Two days after stocks slid in a coordinated risk-off session, and one day after a DOE estimate of US oil inventories sent US stocks surging while the failed Allergan-Pfizer deal unleashed torrential hopes of a biotech M&A spree leading to the single best day for the sector in 5 years, sentiment has again shifted, this time due to a violent surge in the Yen as the market keeps testing the resolve of the Japanese central bank to keep its currency weak, and so far finding it to be nonexistent.