The Good, The Bad, & The Ugly

Via NorthmanTrader.com,

Via NorthmanTrader.com,

Submitted by Harry Dent via EconomyandMarkets.com,

So the S&P 500 is out of correction for now and the coast is clear. NOT! This is exactly what we’ve been predicting would happen – after reaching new lows, stocks would have to bounce before they inevitably resume their longer-term trend, which is down.

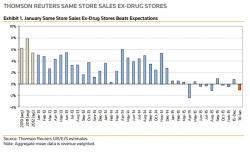

But stocks haven’t been the only victims of late. Just a couple weeks ago the January nonfarm payroll report came in at 151,000 jobs. So much for the expected 190,000! And of the ones reported, they were mostly low-wage jobs.

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Authored by GlobalGold's Claudio Grass, via Acting-Man.com,

With a Gloomy Start to 2016, a Bust Seems just Around the Corner

Markets have corrected substantially since the beginning of the year as most of the gains of the past two years have been erased. According to Bloomberg, 40 out of the largest 63 markets have dropped over 20%. The image below shows the performance of markets word-wide since their most recent peaks. Most markets are in a bear market phase or are at best experiencing a strong correction. The world is red!

Submitted by Lance Roberts via RealInvestmentAdvice.com,

That didn’t take much. After a three-day rally, the media is back into “bullish” mode suggesting the bottom is likely in and by the end of this year, it’s all going to be just fine.

https://player.cnbc.com/p/gZWlPC/cnbc_global