Sweet melt up potential here says Joe Friday

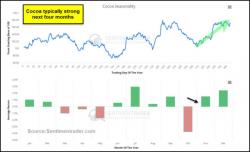

Tis the season for Chocolate (Cocoa) to do well, will it repeat its historical pattern again this year?

Below looks at the seasonal pattern of Cocoa from Sentimentrader

CLICK ON CHART TO ENLARGE

Tis the season for Chocolate (Cocoa) to do well, will it repeat its historical pattern again this year?

Below looks at the seasonal pattern of Cocoa from Sentimentrader

CLICK ON CHART TO ENLARGE

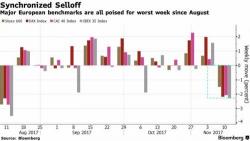

Yesterday's Japan flash-crash inspired selling continues for a second day, with global equities - and bonds - sliding early Friday on concerns U.S. tax reform - and corporate tax cuts - will be delayed after Senate Republicans unveiled a plan that differed significantly from the House of Representatives’ version. After suffering their biggest plunge in 4 months on Thursday, European stocks failed to find a bid along with Asian stocks, while U.S.

Having taken a gamble on bitcoin futures, which are set to begin trading by the end of the year, the CME is now seeking to avoid the consequences of what has emerged as both the cryptocurrency's best and worst selling point: its unprecedented volatility. To do that, the Chicago-based exchange will do what it does to virtually every other asset class traded under its roof, and impose limits on how much prices of bitcoin futures can fluctuate within a day.

The following article by David Haggith was published on The Great Recession Blog:

Following an early shaky start, which saw the Hang Seng tumble as much as 1.6% driven by weakness in financials and real estate names following the latest warning by PBOC governor Zhou about "sudden, complex, hidden, contagious, hazardous" risks In markets and a decline in local real estate prices, and pressure global risk, US equity futures have recouped all losses and are back to unchanged on monday morning, as President Trump continues on his first official trip to Asia.