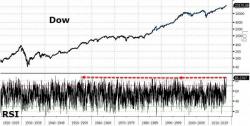

Global Markets Shaken By Sudden Equity Sell-Off: Hong Kong Crashes, VIX Surges

Has the market's "melt-up" levitation finally ended? Of course, it could be much worse: as Bloomberg's Paul Jarvis recalls, thirty years ago on this day traders around the globe were staring at their screens in disbelief as stock markets turned to a sea of red: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -10%, -9% and -10% respectively.